–News Direct–

No matter what you are trading or investing in, no matter what strategies you use, your orders, your profits, and your ROI will be impacted by HFT activity from time to time.

Your goal should be to learn to trade ahead of the HFTs or to avoid HFT activity altogether.

The HFTs are a professional-side market participant group. High Frequency Trading Companies came from the original SOES Bandits of the 1980s and 90s. SOES Bandits were the extremely talented and highly skilled floor traders of the big banks of that era.

When home computers and kit computers came out in the 80s, floor traders decided to quit their high-stress jobs and work at home. Because they were brilliant traders, they knew exactly how to front-run the large-lot orders that came through the exchanges back in those days.

The SOES bandits enraged the Buy Side Institutions and Sell Side Institutions who were constantly front-ran by these floor traders who now were independent professional traders working on a home computer.

In 2001, the Sell Side Institutions had enough of the front-running and went to Congress to ask to have the then fractional price structure of the US markets switched to decimals. They came up with the story that retail investors and retail day traders do not understand fractions and it is hard and unfair to the retail groups as they cant figure out fractional trading. True story. And of course the Congress of that era believed this to be true because so many retail day traders were losing all of their capital base and had huge margin calls.

The Sell Side, which is made up of the big Money Center Banks and giant Financial Services companies, painted a very convincing story and Congress passed the law that changed the US stock market to the decimal price structure we have today. The REAL reason why the Sell Side wanted the price to change to decimals was to squeeze out the SOES Bandits with tight spreads of a few pennies and often less in some instances.

The SOES Bandits quickly realized the old way of Intraday-trading was obsolete. The penny spread made it impossible to make high income from front-running large lots. In addition, the new Dark Pool Alternative Trading Systems had become the central trading venues for the large-lot trading activity of the Buy Side Institutions.

The SOES Bandits became High Frequency Trading Companies almost overnight. They hired the best programmers of that era, chose 6 different strategies to program into their super computers and chose the market OPEN as their primary Maker/Taker order system.

The High Frequency Traders presented their trading strategies to the Public Exchanges to boost liquidity via a direct link routing their orders directly into the exchanges at a millisecond speed.

The exchanges agreed as they were struggling with liquidity issues due to the Dark Pool venues.

The agreement between the NYSE and NASDAQ exchanges also gave the newly named HFTs the status of Maker/Taker, which is a market entity that creates liquidity or removes liquidity within the public exchanges. The HFTs are paid for being Maker/Takers by the exchanges. Today, a few giant HFT firms are designated Market Makers during high stressed market conditions, which require HFTs to sell short to make the market by buying-to-cover after stock prices collapse due to a lack of buyers.

What YOU, as a trader or investor, need to know: HFTs trade on the millisecond and can fill the queues with a thousand small-lot orders in 1 SECOND while you and everyone trading on the Public Exchanges have orders executed on the 1 MINUTE scale.

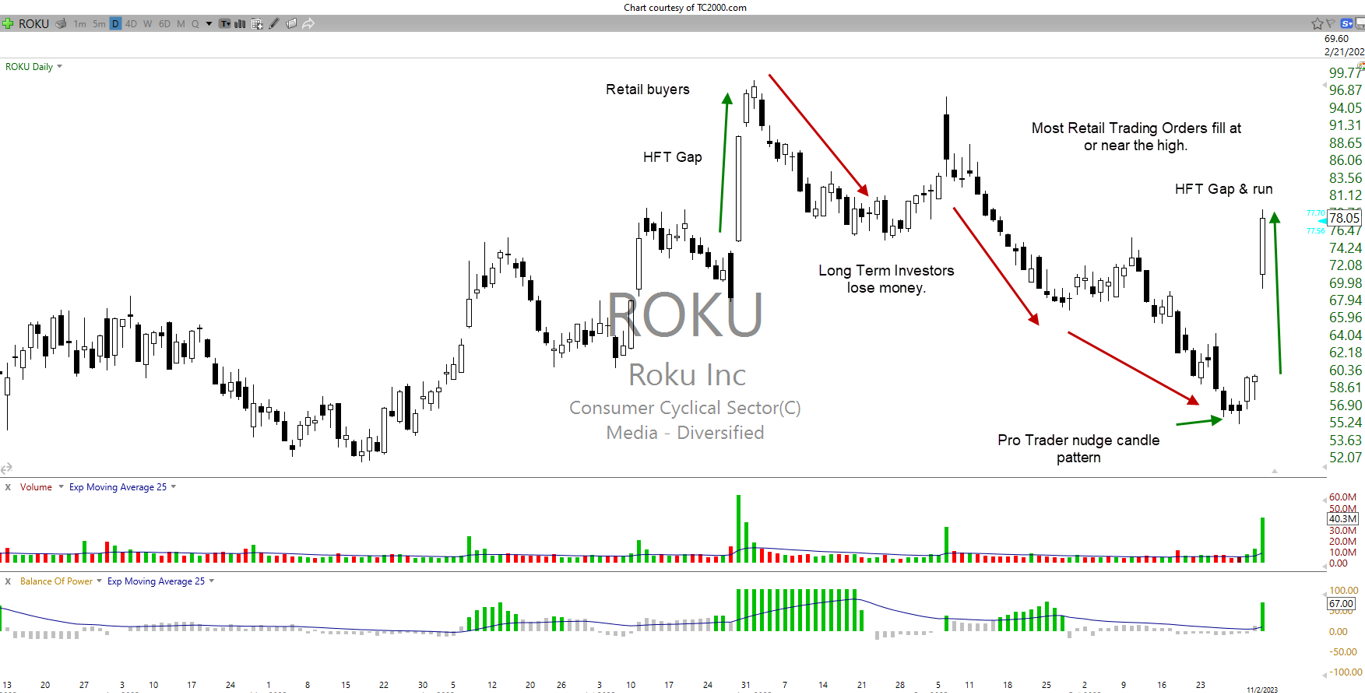

The Chart below shows HFT Gaps Up. You need to be in the stock before the gap up to profit from such action.

Chart Showing HFT Gaps Down at open:

HFT gaps are usually huge and always at the market open.

After more than 20 years, HFTs are an integral part of the market. Exchanges need the liquidity they create on the public stock exchanges since Dark Pools continue to draw huge amounts of liquidity every day.

As an investor, there is nothing more shocking than to see your best performing stocks suddenly gap down at market open due to HFT activity relating to retail news such as earnings or other corporate news.

As a retail trader or Semi-professional trader Trading as a Business under SEC and IRS rules, HFTs can provide sudden huge profits IF you learn the Relational Technical Patterns that precede most HFT gaps.

Since news is late to the retail side, professional traders and floor traders are able to react and buy or sell short a stock before HFTs fill the queues ahead of market open. Once the HFTs have gapped the stock, professionals prepare to take profits immediately as the HFTs will take profits within seconds of the market open, just as retail brokers are either filling retail overnight orders OR sending those orders to Market Makers to fill under Payment for Order Flow agreements.

Learning how to identify the technical setups that trigger the automated HFT systems is crucial to avoiding a huge unexpected loss or reversal of trend. Visit my website to learn more.

Martha Stokes, CMT

https://www.technitrader.courses

TechniTrader has been teaching traders and investors a complete process for trading or investing in the stock market and other financial markets since 1998. We have helped over 500,000 traders and investors achieve their financial goals. Our courses provide a complete, comprehensive training program based on a college-style curriculum that uses a tri-level approach to analyzing assets or derivatives to trade.

Contact Details

Mel Ainuu

Company Website

https://www.technitrader.courses/

View source version on newsdirect.com: https://newsdirect.com/news/high-frequency-trading-firms-avoid-or-trade-ahead-of-them-767836539

TechniTrader

COMTEX_443212142/2655/2023-11-09T08:59:08

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No The Daily News Journal journalist was involved in the writing and production of this article.